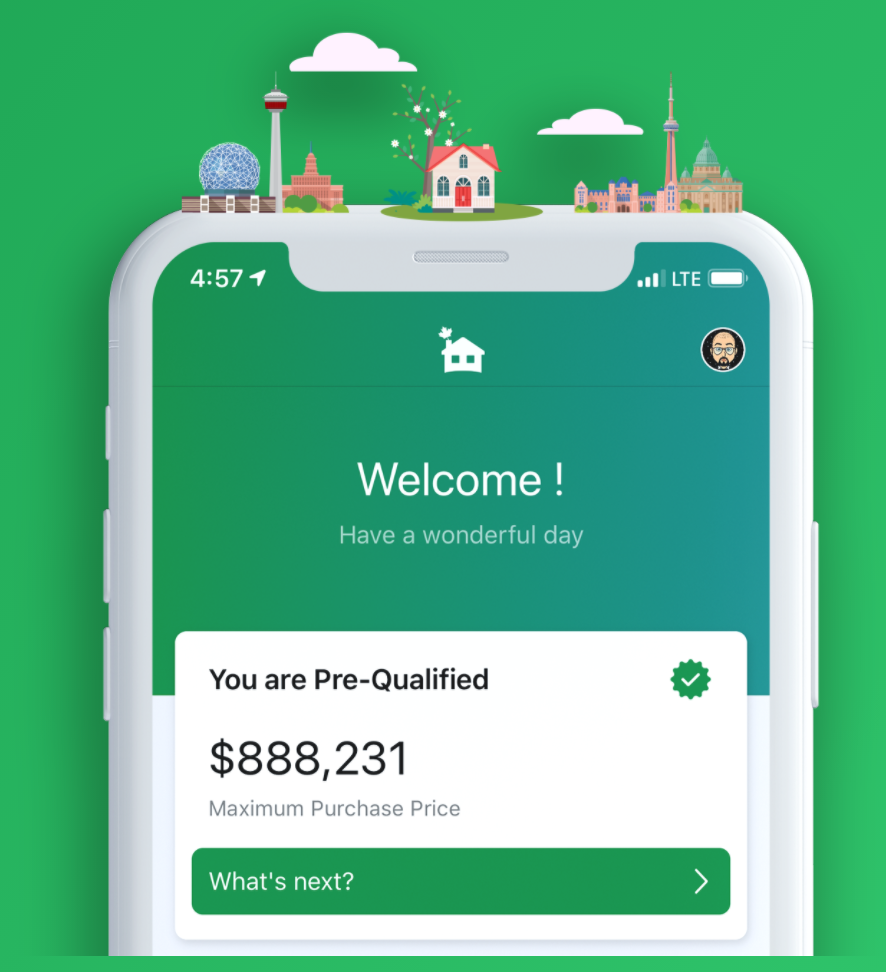

This really is a great tool. You can play with mortgage details like interest rate, term, payment schedule, and come up with what your monthly payments will be based on your purchase price.

When you buy a home, there are some costs that you might not be expecting,. Real estate fees are paid for by the seller (in most cases) but there is a land transfer tax that needs to be paid by the buyer. This is based on the price of the home. In some cases, you might qualify for a rebate on this cost. The app help you determine what that cost will be. It also includes things such as lawyer fees, moving costs, HST (if applicable) and adjustment estimates for property tax/utilities giving you a really good idea of the money you will need on hand come closing time.

Once you figure out what your monthly mortgage payment will be, the tool also lets you budget other costs to give you a full monthly picture of your home owning expenses. Things like property tax, heat, condo fees.

Banks will be happy to set you up with a mortgage that the stress test says you can afford. Their tests don’t look at all of your monthly expenses and leave many people struggling to make ends meet. Some pre-planning ahead of time will help you to look within your realistic budget when buying your next home.