Not the best time in real estate

By far, the past couple of years has been some of the worst times in real estate. The pandemic forced people to stay in their homes, and stay they did! The number of listings is the lowest it has been in many years. With interest rates incredibly low and many people wanting to get into the market, the demand on homes has gone sky high. A perfect storm generating a very strong seller’s market.

New buyers are quickly having their dream of home ownership pushed away from them as home prices rise. Without an adequate supply of homes to choose from, the ones that do show up are selling well above the listing price and are often subject to bidding wars. In just one year, the price of homes jumped over 20%. i.e. a $300k house at the beginning of 2021 would now fetch about $360k (or more).

It is disheartening to also learn that more than 30% of the active buyers are those looking to invest in rental homes. They usually have more than 2 homes in their possession and buy the homes strictly as rental properties. These buyers typically have a lot more buying power than a first time home buyer and are more able to bid on a house with no conditions – a very risky proposition for most people buying. There are some rumours that there will be some restrictions imposed upon these buyer by the Government shortly to help curb this activity and give others more of a chance. More to come on that.

Sellers find themselves in a catch 22 situation. Many sellers are looking to move up or down and not get out of the home market altogether. So, in order to sell, they need to have someplace to go to. So they find themselves in the buyer column, also struggling with competing offers where a condition on sale of their property will almost never be accepted when others are willing to buy with no conditions. So they must wait it out until their financial situation changes or they are willing to risk the sale without the condition on sale of their current home.

As an agent, we are ready and willing to help out both sides but there simply are not many opportunities available. We also must wait for the market to become more balanced before we can really be effective.

The good news is that things are always changing. This market will adjust and more opportunities will become available again. Policy changes, economic changes and the subsiding of the pandemic are all things that can and will change the market. Let’s just hope that those things that make positive change come soon! For everyone’s sake.

Who has “the file” on your house?

It is definitely not a given that a seller will want to use a family member in real estate to sell their home. There are lots of reasons for this. Sometimes they feel like they don’t want their family member to know too much of their financial secrets or maybe don’t want them to know that they have property to sell. That can sometimes cause fights in families and the seller may want to avoid any problems. More often than not, the reason for them not choosing them as an agent comes down to the seller not understanding how the agent is paid. They assume agents receive a salary or other regular compensation and don’t want to be a bother to them. Granted, it is also the fault of the family realtor for not speaking to everyone about their job and asking them to support them for future home sales.

It is definitely not a given that a seller will want to use a family member in real estate to sell their home. There are lots of reasons for this. Sometimes they feel like they don’t want their family member to know too much of their financial secrets or maybe don’t want them to know that they have property to sell. That can sometimes cause fights in families and the seller may want to avoid any problems. More often than not, the reason for them not choosing them as an agent comes down to the seller not understanding how the agent is paid. They assume agents receive a salary or other regular compensation and don’t want to be a bother to them. Granted, it is also the fault of the family realtor for not speaking to everyone about their job and asking them to support them for future home sales.Dates and times in contracts

The dates and times are in the contract for a good reason and do often cause deals to crumble. Right away, agreements of purchase and sale have irrevocable date and times that are very important. If the time passes and the offer has not been accepted and signed, then that offer becomes dead and unenforceable. Another critical date is the deposit acceptance date. Usually this is setup for 24 hours or earlier from when the agreement is accepted. If the deposit is not received within that timeline, then again, the deal could be considered dead and no longer binding.

The dates and times are in the contract for a good reason and do often cause deals to crumble. Right away, agreements of purchase and sale have irrevocable date and times that are very important. If the time passes and the offer has not been accepted and signed, then that offer becomes dead and unenforceable. Another critical date is the deposit acceptance date. Usually this is setup for 24 hours or earlier from when the agreement is accepted. If the deposit is not received within that timeline, then again, the deal could be considered dead and no longer binding. Winter Selling Tips

Summertime pictures usually help to show off the home, especially if it has some nice gardens and curb appeal. You want to showcase the home at its best so that the buyer can dream of their life in that space. If you are selling waterfront, include a picture of the dock, boating, fishing, or whatever else they might be doing outside. Buyers will want to see the condition of the roof, the driveway and walking paths. You can leave the pictures on the kitchen or dining table for the buyers to check out when they do a tour.

Summertime pictures usually help to show off the home, especially if it has some nice gardens and curb appeal. You want to showcase the home at its best so that the buyer can dream of their life in that space. If you are selling waterfront, include a picture of the dock, boating, fishing, or whatever else they might be doing outside. Buyers will want to see the condition of the roof, the driveway and walking paths. You can leave the pictures on the kitchen or dining table for the buyers to check out when they do a tour. When is the best time to sell?

How do real estate agents get paid?

Deposit vs Down Payment

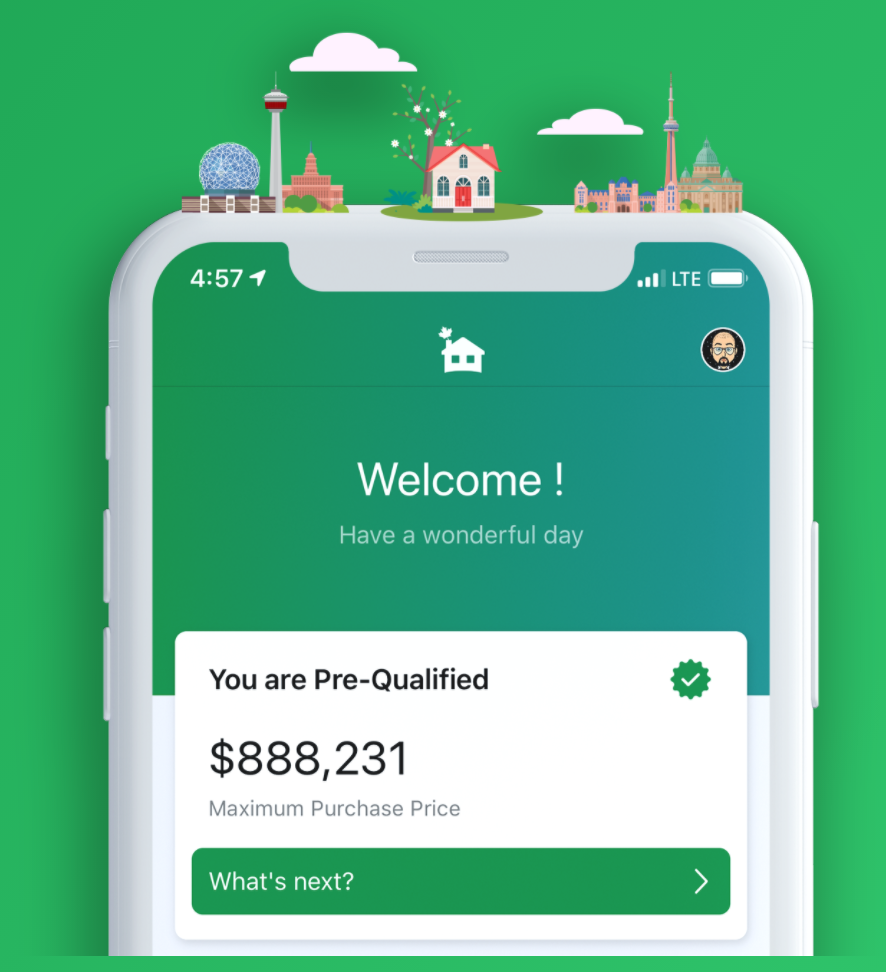

Canadian Mortgage App

Is Co-Owning a home an option for you?

Home Sale Preparations

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link